In response to the Bank Negara Malaysia (BNM) order earlier this week, CIMB Group has decided to take its own security measures to provide its customers with higher protection. It seems that the improvements promised by the bank are similar to those revealed by Maybank recently.

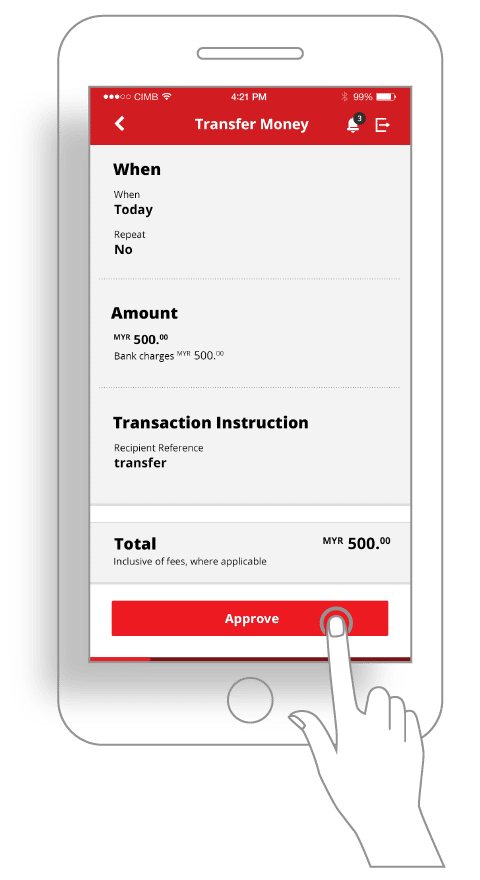

CIMB has announced that it will move away from OTP SMS during the first half of next year. Customers will see that the sole authentication method offered will be SecureTAC via the CIMB Clicks App. Moreover, to further safeguard its customers from financial scams, CIMB will implement a customer verification callback process for all new online banking registration and new secure device activation.

Most importantly, the bank also revealed that it will cease sending customers SMS messages with embedded links by the end of the year. So, you may safely disregard any text message that claims to be from your bank but contains a live URL.

Similar to what Maybank has imposed, CIMB will also introduce procedures to restrict users to having just one secure mobile device for authenticating banking transactions. These restrictions will take effect soon. It is anticipated that this will become live by the end of October.

In addition, CIMB is also working on a feature that will allow users to temporarily suspend their own accounts if they have reason to believe that their financial information has been stolen. This feature is planned for inclusion on its digital banking platform sometime in the first half of 2023.

It is hoped that the efforts taken by our local banks will prevent from more people being roped into scamming tactics in the future.

Source: (1)